Crypto Currents

Developments shaping the cryptocurrency ecosystem, curated from trusted sources. Each article is summarised by AI into 50 words or fewer for fast context.

Oil price surge may lead to 45% drop in Bitcoin value, analysts warn

Analysts suggest that a significant increase in oil prices could pressure the Federal Reserve to postpone interest rate cuts, potentially causing Bitcoin's value to plummet by 45%.

XRP approaches $1.40 as SOPR indicates potential market capitulation

XRP is nearing the $1.40 mark, with the SOPR metric suggesting a possible capitulation phase in the market. Analysts are considering whether this signals an impending recovery for the cryptocurrency.

Vancouver Mayor's Bitcoin Reserve Proposal Faces Legal Challenges

Vancouver's Mayor has encountered legal obstacles in his plan to establish a Bitcoin reserve for the city, raising concerns about regulatory compliance and financial implications.

Bitcoin price falls to approximately $68K amid US jobs market concerns

Bitcoin's price has decreased to near $68,000 as weakness in the US jobs market fails to support bullish trends.

Private credit market faces challenges, impacting Bitcoin's stability

The private credit market, valued at $3 trillion, is showing signs of instability, which may have repercussions for Bitcoin and its market dynamics.

Stablecoins Rise Amid Positive Jobs Data and Evolving Crypto Trends

The article discusses the increasing prominence of stablecoins in the cryptocurrency market, influenced by positive employment data and a shift away from traditional hedge flows.

Market Makers Predict Early Price Targets for Top Crypto BlockDAG

Market makers have outlined their early price predictions for a leading crypto BlockDAG, suggesting a potential rise to $0.20 initially, followed by a target of $0.50.

Top 5 Cryptocurrencies to Consider During Market Recovery

A list of five undervalued cryptocurrencies is presented as potential investments amid the current market recovery.

Bitcoin ETFs Experience First Outflow of $227 Million in March

Bitcoin exchange-traded funds (ETFs) recorded their first outflow in March, totalling $227 million, indicating a shift in investor sentiment.

Nine Cryptocurrencies Face Potential Delisting from Binance Exchange

Binance has identified nine cryptocurrencies that may be at risk of delisting due to various compliance issues. The exchange is reviewing these assets to ensure they meet its operational standards.

XRP Whales Accumulate Over 4.18 Billion XRP Following Price Drop

XRP whales have added more than 4.18 billion XRP to their holdings since the recent price flash crash in October.

Strike Obtains New York BitLicense and Money Transmitter License

Strike has successfully secured a BitLicense and a Money Transmitter License from the New York Department of Financial Services, enabling it to operate legally in the state.

Cardano Foundation CEO Highlights Need for AI Accountability Measures

The CEO of the Cardano Foundation emphasises the importance of establishing accountability in artificial intelligence, pointing out current gaps in regulation and oversight.

Top Crypto Payment Gateways in Thailand for Reliable Transactions

The article reviews the most dependable cryptocurrency payment gateways available in Thailand, highlighting their features and benefits for users.

Russia Explores Simplified Licensing for Bank-Run Crypto Exchanges

Russian authorities are considering a streamlined licensing process for cryptocurrency exchanges operated by banks, aiming to regulate the sector more effectively.

Western Union launches stablecoin on Solana, boosting interest in Pepeto

Western Union has introduced a stablecoin on the Solana blockchain, leading to increased attention on the Pepeto cryptocurrency, which is currently outperforming SOL and LINK.

38% of Altcoins Trade Below FTX-Crash Lows, Indicating Market Struggles

A significant portion of altcoins, 38%, are currently trading below their values at the time of the FTX crash, highlighting ongoing challenges in the cryptocurrency market.

Bitcoin Price Drops Below $70K Amid Rising US Oil Prices Due to Iran Conflict

Bitcoin's price has fallen below $70,000 as the ongoing conflict in Iran contributes to a rise in US oil prices, reaching a two-year high.

U.S. Nonfarm Payrolls Decrease by 92,000 in Latest Jobs Report

The latest U.S. jobs report reveals a decline of 92,000 nonfarm payrolls, impacting economic forecasts and contributing to a drop in Bitcoin's value.

$15.19 Million LINK Transfer Occurs Amid Channel Break Analysis

A significant transfer of $15.19 million in LINK has been noted alongside a channel break, raising questions about the potential for a drop to $9.60.

Utexo Secures $7.5M Funding from Tether for USDT Settlements on Bitcoin

Utexo has raised $7.5 million in funding, led by Tether, to develop native USDT settlements on the Bitcoin network.

Lummis Indicates Lawmakers Consider Bitcoin Payments Exempt from Capital Gains Tax

Senator Cynthia Lummis has stated that lawmakers are exploring the possibility of allowing Bitcoin payments without incurring capital gains tax, aiming to encourage cryptocurrency adoption.

$PUMP Whale Withdraws $14.56 Million in Tokens from Exchanges

A significant holder of $PUMP tokens has withdrawn $14.56 million worth of tokens from exchanges over a period of ten days, indicating potential market movements.

Strike Obtains New York BitLicense for Bitcoin Financial Services

Strike has secured a BitLicense in New York, allowing it to offer Bitcoin financial services to residents of the state.

Kazakhstan Central Bank Plans $350M Crypto-Linked Portfolio for Spring

The Central Bank of Kazakhstan is preparing to launch a $350 million portfolio linked to cryptocurrencies, aiming for a start in spring.

SEC's review of ETF leverage may increase Bitcoin volatility in April

The SEC is set to review the market behind ETF leverage, which could lead to significant volatility in Bitcoin prices during April.

NYSE Acquires Stake in Major Cryptocurrency Exchange

The New York Stock Exchange has purchased a stake in a significant cryptocurrency exchange, marking a notable development in the integration of traditional finance with digital assets.

IPO Genie vs Nexchain: Comparing Crypto Presales for Future Growth

The article evaluates the potential of IPO Genie and Nexchain as crypto presales, analysing which may offer greater returns by 2026.

Ethereum price prediction suggests $1,900 may be a buy zone for traders

Analysts are discussing whether Ethereum traders should consider the $1,900 price level as a potential buying opportunity amid current market trends.

XRP Could Break $1.45 Resistance, Bitcoin Rally Expected After September

Peter Brandt suggests Bitcoin may not see a rally until after September. Meanwhile, Shiba Inu experiences significant exchange inflow, reaching a high of 844 billion.

Bitcoin ETFs Experience $228 Million Outflow Amidst Stabilising Long-Term Flows

Bitcoin exchange-traded funds (ETFs) have seen a significant outflow of $228 million, although longer-term investment flows appear to be stabilising.

Stablecoin Market Capitalisation Reaches Record $312 Billion

The stablecoin market cap has reached a record $312 billion, indicating a significant influx of liquidity into decentralised finance (DeFi) platforms.

Bitcoin Market Analysts Identify Potential Buying Opportunity

Market analysts suggest that current conditions may present a significant buying opportunity for Bitcoin, indicating a potentially bullish trend for investors.

Litecoin Remains Stable Above $50 Mark

Litecoin has maintained its value above the $50 threshold, showing resilience in the current market conditions.

Samson Mow Criticises Michael Saylor's Bitcoin Insufficiency Statement

Samson Mow has publicly disagreed with Michael Saylor's recent comments regarding Bitcoin's sufficiency, highlighting differing views within the cryptocurrency community.

Dogecoin's Trading Volume Drops by 50%: Potential Price Impact

Dogecoin has experienced a significant 50% decrease in its trading volume. Analysts are examining whether this decline will have a tangible effect on the cryptocurrency's price in the market.

Bitcoin traders debate potential repeat of 2022 crash after $74K peak

Traders are divided on whether Bitcoin's recent peak at $74,000 signals a bull trap, reminiscent of the 2022 crash. Opinions vary on market trends and future price movements.

Humanity Protocol's H token rises 39%, eyes $0.20 target

The H token of Humanity Protocol has surged by 39%, prompting speculation about its potential to reach the $0.20 mark. Analysts are monitoring key price levels to determine future movements.

Sentio Partners with Chainbase to Develop AI-Ready On-Chain Data Infrastructure

Sentio has announced a partnership with Chainbase to create an AI-ready on-chain data infrastructure, aiming to enhance data accessibility and usability for blockchain applications.

Stablecoins: Examining Their Role in Finance and Technology

The article explores the impact of stablecoins on traditional banking, their integration with AI technologies, and their potential use in circumventing sanctions, particularly in the context of Russia.

Vitalik Buterin Discusses AI Integration in Ethereum Wallets

Vitalik Buterin outlines the advantages and disadvantages of incorporating artificial intelligence into Ethereum wallets, highlighting potential benefits and risks associated with such integration.

XRP Price Predictions: Below $1 or Spike to $2 Amidst Expected Volatility

Analysts suggest that XRP's price may either drop below $1 or surge to $2 as volatility is anticipated in the market.

Vancouver Cancels Bitcoin Reserve Initiative Amidst Increasing State Adoption

Vancouver has decided to halt its plan to establish a Bitcoin reserve, despite a trend of growing adoption of cryptocurrency by various states.

Macro Events Influence Cryptocurrency Trading Opportunities, Says PrimeXBT

PrimeXBT discusses how macroeconomic events can significantly impact cryptocurrency markets, creating trading opportunities for investors. The analysis highlights the importance of staying informed about global developments.

SHIB Burns Remain at Zero for Second Day as Crypto Market Surges

SHIB token burns have not increased for two consecutive days, despite a rising trend in the broader cryptocurrency market.

FBI Arrests Individual Linked to $46 Million Bitcoin Theft from US Marshals

The FBI has arrested a suspect in connection with the theft of $46 million in Bitcoin from the US Marshals Service. The investigation continues as authorities work to recover the stolen assets.

Bitcoin ETFs experience $228 million in outflows amid market challenges

Bitcoin spot ETFs have recorded $228 million in outflows, indicating ongoing struggles in the market despite a recent relief rally.

32,000 BTC Withdrawn from Exchanges in One Day, Raising Concerns

A significant outflow of 32,000 Bitcoin from exchanges has been reported, described as anomalous. This event has raised concerns among analysts regarding market stability and potential implications for Bitcoin's price.

SEC proposes $10 million settlement in Justin Sun case

The SEC has moved to settle its case against Justin Sun for $10 million, raising questions about the future of Tron cryptocurrency.

Jack Mallers' Strike obtains crypto and money licenses in New York

Strike, led by Jack Mallers, has secured both a BitLicense and a money transmitter licence from the New York Department of Financial Services, enabling expanded operations in the state.

Bitcoin mining profit drops to $300 per BTC as costs exceed $70,000

Bitcoin mining profitability has fallen to $300 per BTC due to rising costs surpassing $70,000. Wall Street is reportedly funding miners' ventures into artificial intelligence as a potential alternative.

Judge orders freeze of 71 Bitcoin in BlockFills customer fund dispute

A judge has frozen 71 Bitcoin in the BlockFills case amid claims regarding customer funds. The decision comes as part of ongoing legal proceedings involving Dominion Capital.

Bybit and Tether Introduce $1 Million Tokenised Gold Initiative

Bybit and Tether have launched a campaign featuring tokenised gold worth $1 million, aimed at enhancing investment opportunities in digital assets.

Bitcoin Remains Above $70K, Yet Bull Market Uncertain

Bitcoin has maintained a value above $70,000, but analysts suggest that a bull market may not be imminent due to various market factors.

Cardano Payments Introduced in 137 SPAR Stores Across Switzerland

Cardano has launched its payment system in 137 SPAR stores in Switzerland, enabling customers to use the cryptocurrency for purchases.

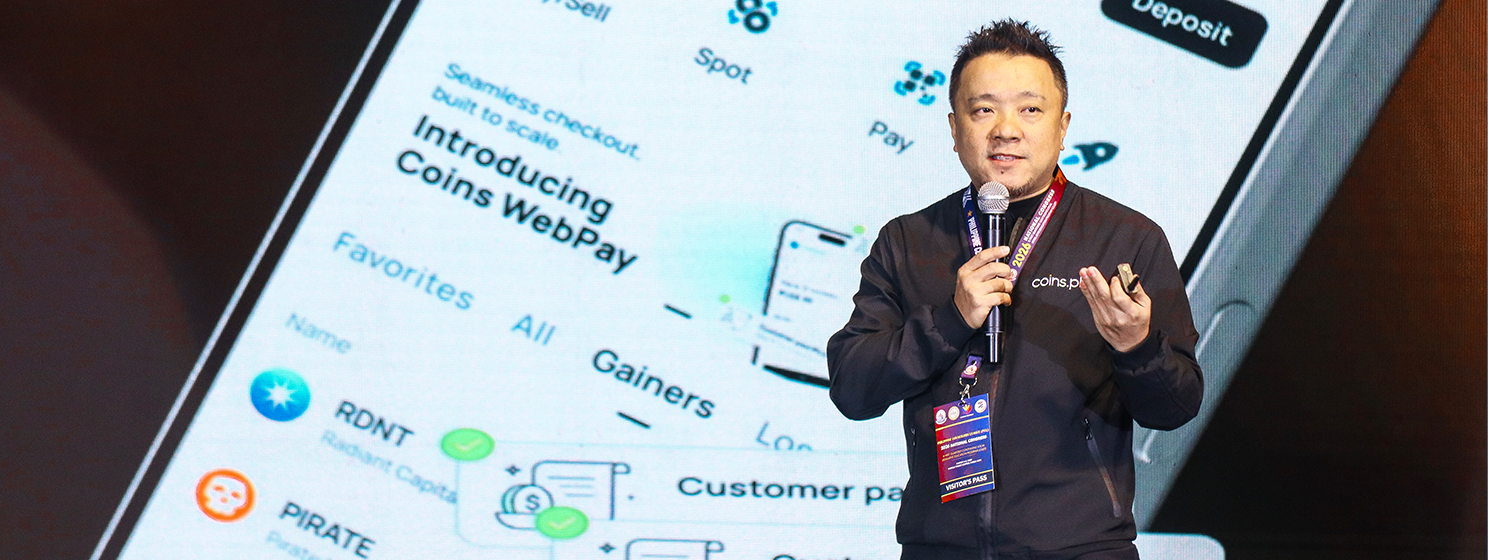

Coins.ph CEO calls for action against payment inefficiency at PCL Congress

Wei Zhou, CEO of Coins.ph, urged local leaders to address the issue of payment inefficiency, referred to as the 'Invisible Tax', during the PCL National Congress.

Crypto Market Faces Volatility Ahead of Options Expiry and Economic Data Release

The cryptocurrency market is experiencing heightened volatility as institutional investors prepare for the expiry of Bitcoin, Ethereum, and XRP options, coinciding with the upcoming nonfarm payrolls report.

Bitcoin Wallet Adoption Reaches 58.45 Million, Setting New Record

Bitcoin has achieved an all-time high of 58.45 million wallets, indicating unprecedented adoption levels among users.

VanEck CEO suggests Bitcoin could be nearing a market bottom

The CEO of VanEck has indicated that Bitcoin may be forming a market bottom, suggesting potential stability in its price after recent fluctuations.

SEC Reaches Settlement with TRON Founder Justin Sun

The US Securities and Exchange Commission has settled its lawsuit against Justin Sun, the founder of TRON, resolving allegations related to unregistered securities offerings.

Bitcoin ETFs Experience Outflows Following Recent Inflow Streak

Bitcoin exchange-traded funds (ETFs) recorded outflows on Thursday after a period of strong inflows, indicating a shift in investor sentiment.

Bitcoin and stocks show stability amid uncertainty in bond market

Bitcoin and stock markets have stabilised, but the bond market remains sceptical about potential interest rate cuts by the Federal Reserve.

Bitcoin and stocks stabilise as bond market signals uncertainty over Fed rate cuts

Bitcoin and stock markets show signs of stabilisation, but the bond market remains sceptical about potential interest rate cuts by the Federal Reserve.

$2.6 Billion Bitcoin Options Set to Expire, Raising Market Concerns

The upcoming expiry of $2.6 billion in Bitcoin options has sparked concerns about potential market volatility and the phenomenon known as 'max pain' for traders.

Coinbase Board and CEO Brian Armstrong Sued Over Alleged Misconduct

A new lawsuit has been filed against the Coinbase board, including CEO Brian Armstrong, alleging misconduct related to the company's operations and governance.

Solana's Payments Surge by 755%: Potential for a SOL Supercycle

Solana has experienced a significant 755% increase in payment transactions. This surge raises questions about the potential for a supercycle in the value of SOL, as the cryptocurrency market reacts to this growth.

Moongate and TON Blockchain Collaborate on Web3 Ticketing Solutions

Moongate and TON Blockchain have partnered to enhance Web3 ticketing by integrating seamless crypto and fiat payment options, aiming to improve user experience and accessibility in the ticketing industry.

Russia Develops Strategic Framework for Domestic Stablecoin Use

Russia is advancing a strategic framework for stablecoins aimed at securing its domestic economic interests.

IRS Proposes Digital-Only Transformation for Cryptocurrency Tax Reporting

The IRS has proposed a digital-only approach to enhance compliance in cryptocurrency tax reporting, aiming to streamline processes and improve accuracy.

OKX Introduces 'Orbit' Social Trading Network Featuring Verified Metrics

OKX has launched 'Orbit', a new social trading network that provides verified performance metrics for users. This platform aims to enhance transparency and trust in trading activities.

ETH Price Analysis: Potential Bull Trap or Final Buying Opportunity

Ethereum's price is currently at a critical juncture, raising questions about whether it is a bull trap or a last chance for investors to buy at lower prices.

Vancouver Bitcoin reserve initiative faces opposition from city officials

City officials in Vancouver have resisted a proposal to establish a Bitcoin reserve, citing restrictions in the city charter.

American Bitcoin Corp strengthens institutional position with 6,500 BTC treasury

American Bitcoin Corp has enhanced its institutional credibility by acquiring a treasury of 6,500 Bitcoin, signalling its commitment to the cryptocurrency market.

Backpack Appoints Mark Wetjen as Head of US Expansion

Backpack has announced the appointment of former CFTC Chair Mark Wetjen to lead its expansion efforts in the United States.

SEC concludes fraud case against Justin Sun following $10 million settlement

The US Securities and Exchange Commission has ended its fraud case against Justin Sun after he agreed to a settlement of $10 million.

Comparison of Dogeball, Eggman, and Ozak AI for Future Crypto Presales

An analysis of three cryptocurrency projects, Dogeball, Eggman, and Ozak AI, to determine which may qualify as a significant presale opportunity in 2026.

Revolut Seeks National Bank Charter for US Operations

Revolut has submitted an application for a national bank charter in the United States, aiming to expand its full-scale operations in the country.

Altcoin Social Buzz Reaches Lowest Level in Two Years

Social media activity surrounding altcoins has fallen to a two-year low as investors shift focus to more stable assets.

ICE Invests in OKX to Connect Traditional Finance with Blockchain

Intercontinental Exchange has announced an investment in cryptocurrency exchange OKX, aiming to integrate traditional financial markets with blockchain technology.

US Regulators Propose New Rules for Crypto and Prediction Markets

US regulatory agencies have submitted proposals for new regulations concerning cryptocurrency and prediction markets to the White House for review.

Bitcoin Surges to $74,000 Amidst $583 Million in Short Liquidations

Bitcoin's price reached $74,000 following significant short liquidations totalling $583 million, impacting the cryptocurrency market.

Digital asset losses in February reach lowest level since March 2025

February saw digital asset losses decline to their lowest level since March 2025, indicating a potential stabilisation in the market.

TRON Price Rises Following SEC's Dismissal of Lawsuit Against Justin Sun

The price of TRON has increased after the SEC dropped its lawsuit against founder Justin Sun, impacting market sentiment positively.

Bitcoin Reserves on Centralised Exchanges Reach Lowest Level Since November 2018

Bitcoin reserves on centralised exchanges have fallen to their lowest level since November 2018, indicating a significant shift in market dynamics and investor behaviour.

Analysis of the U.S. Crypto Market's Future Developments

The article explores anticipated changes in the U.S. cryptocurrency market by 2026, highlighting unexpected shifts and trends that may impact investors and regulatory frameworks.

Bitcoin Bears Lose Ground as Negative Funding Impacts Market Dynamics

Recent analysis indicates that Bitcoin bears are losing their influence in the market, with negative funding rates being the primary factor preventing a significant breakout.

Decred's DCR Price Analysis: Will Buyers Reach $36.7 Liquidity?

Analysts are examining whether buyers of Decred's DCR can drive the price towards the $36.7 liquidity level. The outcome may depend on market trends and buyer sentiment.

Arthur Hayes Predicts Rising Oil Prices Will Prompt Fed to Print More Money

Arthur Hayes suggests that increasing oil prices may lead the Federal Reserve to implement more money printing, which could impact Bitcoin's market movement.

Canada's Top 5 Bank Launches New Multi-Asset Crypto ETF

A leading Canadian bank has introduced a multi-asset fund that includes cryptocurrency, marking a significant move in the financial sector towards digital assets.

PI's 14% Price Increase Faces Risks Linked to Bitcoin Correlation

PI's recent 14% price rise may encounter downside risks due to its correlation with Bitcoin, which could impact its stability in the market.

AI Scam Surge Highlights Indonesia's Technology Preparedness Issues

A recent increase in AI-related scams in Indonesia has revealed significant gaps in the country's technological readiness and cybersecurity measures.

NYSE Parent ICE Invests in Cryptocurrency Exchange OKX

Intercontinental Exchange, the parent company of the NYSE, has made an investment in cryptocurrency exchange OKX, indicating a strengthening relationship between traditional finance and the cryptocurrency sector.

Federal Agencies Clarify Regulations on Blockchain-Based Securities

The Federal Reserve, FDIC, and OCC have issued a clarification regarding the regulatory framework for blockchain-based securities, aiming to provide guidance for financial institutions and enhance understanding of compliance requirements.

Bitcoin relief rally encounters challenges amid ongoing bear market, say analysts

Analysts report that the recent Bitcoin relief rally is struggling due to persistent bear market conditions, highlighting ongoing challenges for the cryptocurrency.

Lyn Alden predicts Bitcoin will outperform gold in coming years

Macroeconomist Lyn Alden forecasts that Bitcoin will surpass gold in performance over the next two to three years, citing various economic factors influencing this trend.

Ethereum Records 29.6 Million ETH Turnover Amid Speculative Concerns

Ethereum has reached a record turnover of 29.6 million ETH, raising concerns about a potential speculative trap in the market.

Zcash price prediction: Traders' expectations for upcoming weeks

Traders are analysing Zcash's price movements and trends to forecast its performance in the coming weeks.

Solv Protocol offers 10% bounty after $2.7 million theft

Solv Protocol has announced a 10% bounty for information leading to the recovery of $2.7 million stolen by a hacker.